Chart Of Accounts Vat Finest Ultimate Prime

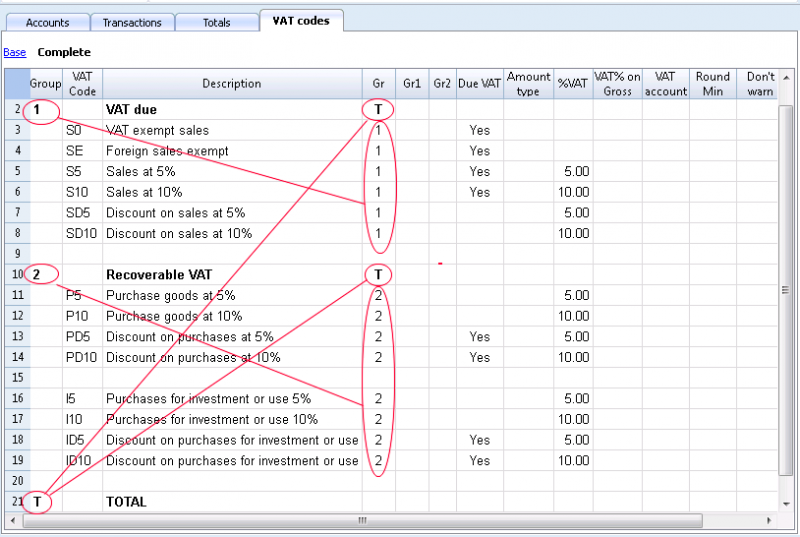

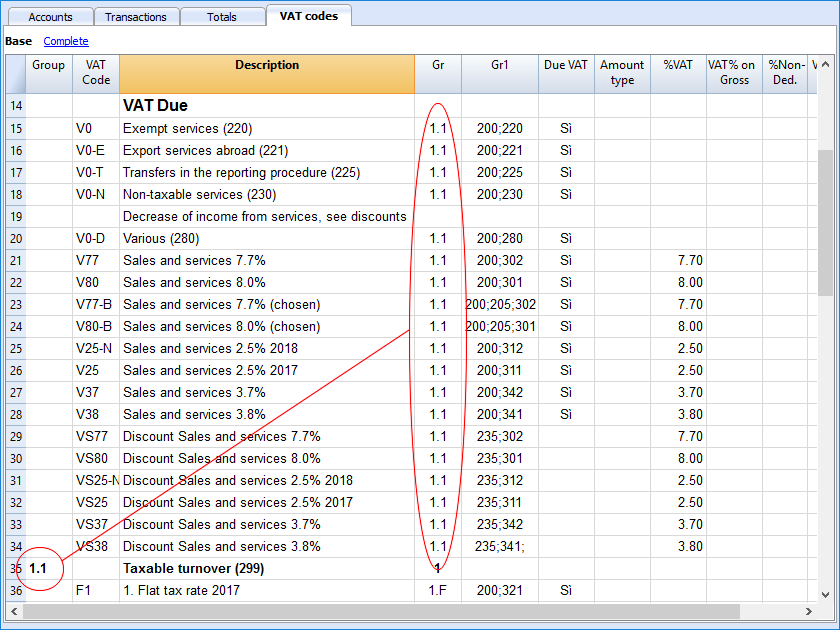

chart of accounts vat. The codes above are the default chart of accounts codes xero supplies when you open your account. Vat is usually categorized into two categories.

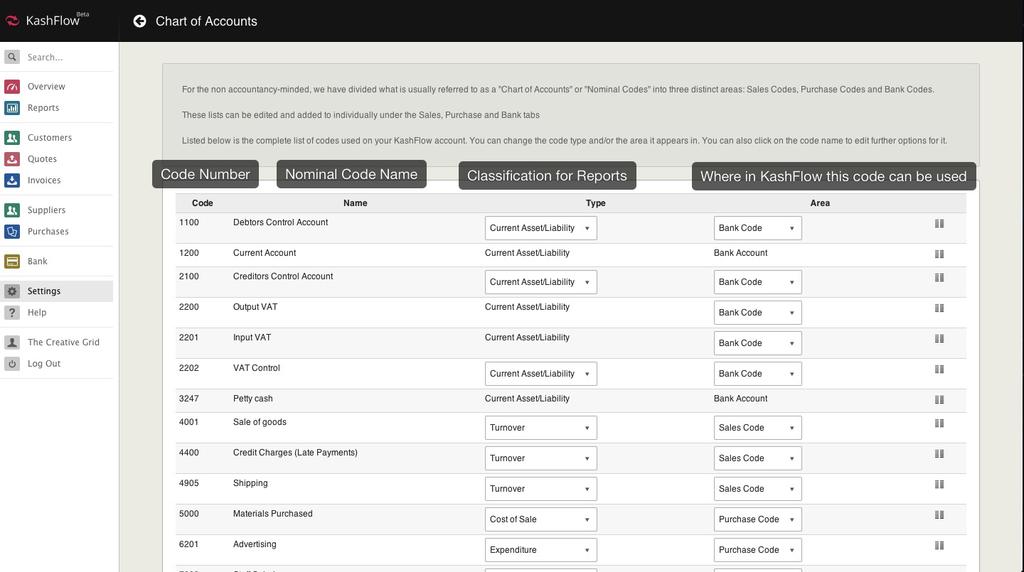

chart of accounts vat There are five vat nominal accounts in the chart of accounts. Value added tax (vat) is an indirect tax which is charged on the supply of taxable goods and rendering of taxable services. When you enter a transaction, the vat scheme determines which codes the vat.

It Also Shows You The Main Financial Statement In.

There are five vat nominal accounts in the chart of accounts. Vat input is recorded when there is a purchase of goods. Value added tax (vat) is an indirect tax which is charged on the supply of taxable goods and rendering of taxable services.

The Codes Above Are The Default Chart Of Accounts Codes Xero Supplies When You Open Your Account.

Vat is usually categorized into two categories. I.e., input vat and output vat. 71 rows in this ultimate guide, not only do we explore examples of a common chart of accounts but also we discuss best practices on how to properly set up your chart of.

Each Organisation Will Start Off With A Default Chart Of Accounts, Which.

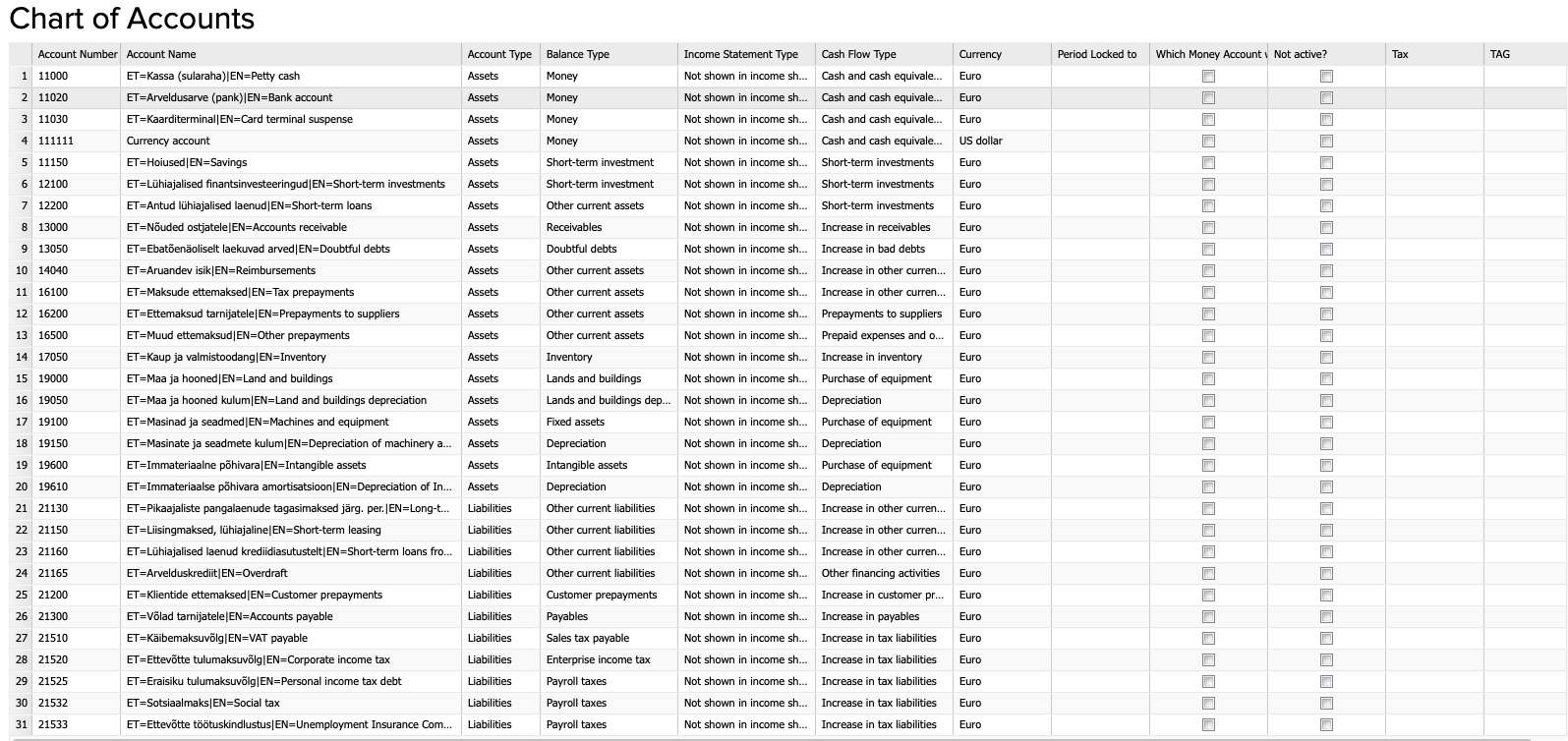

When you enter a transaction, the vat scheme determines which codes the vat. If you prefer, you can. The chart of accounts is a list of all the accounts used by an organisation.

Adding Custom Chart Of Accounts Codes To Xero.

148 rows the chart of accounts example table below acts as a quick reference to help you set up your chart of accounts.

Leave a Reply