Trading Chart Backtesting Assessment Overview

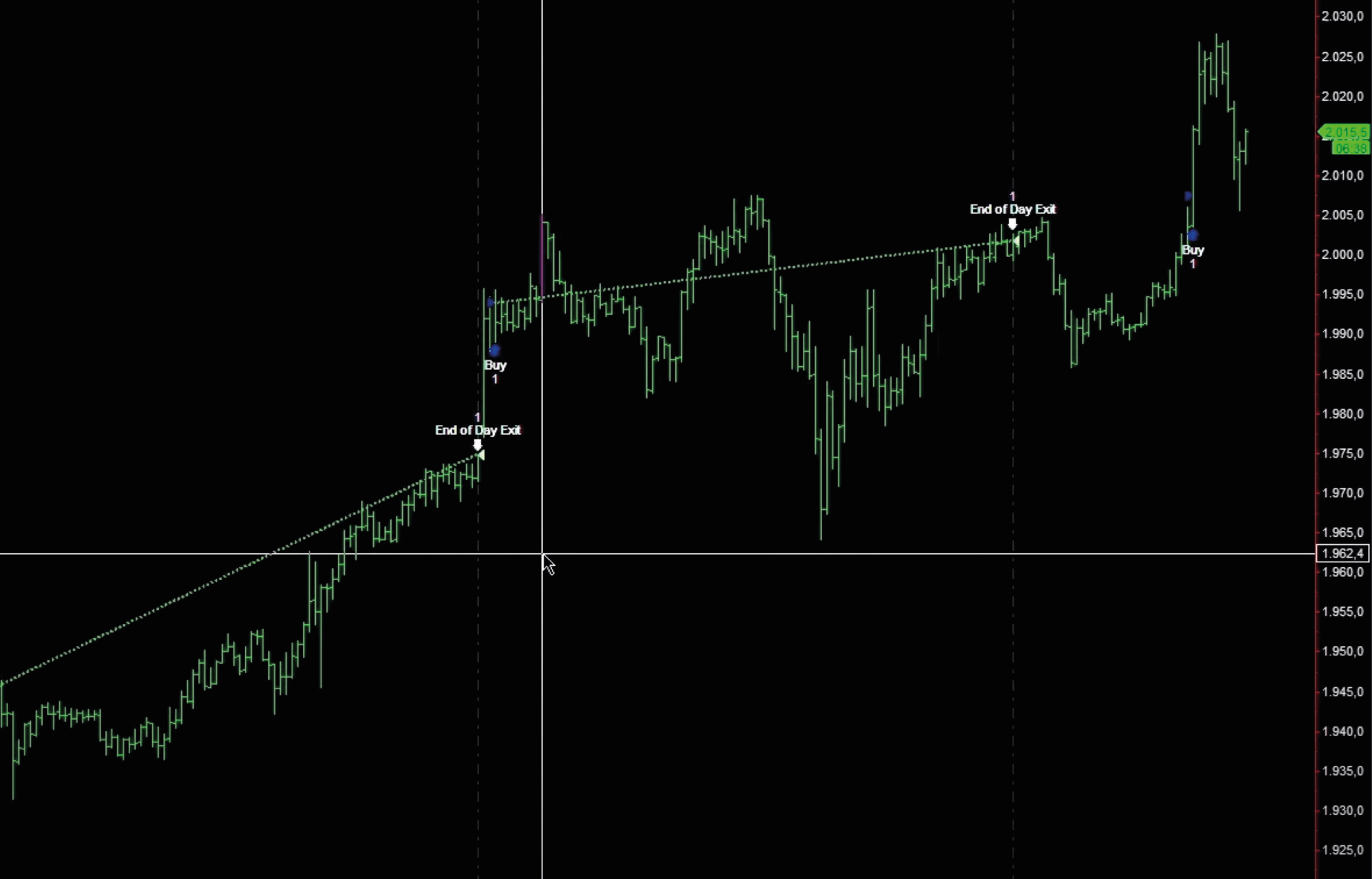

trading chart backtesting. To backtest, click on the. Backtesting trading is an effective strategy or a method to determine the market’s previous performance based on how well or.

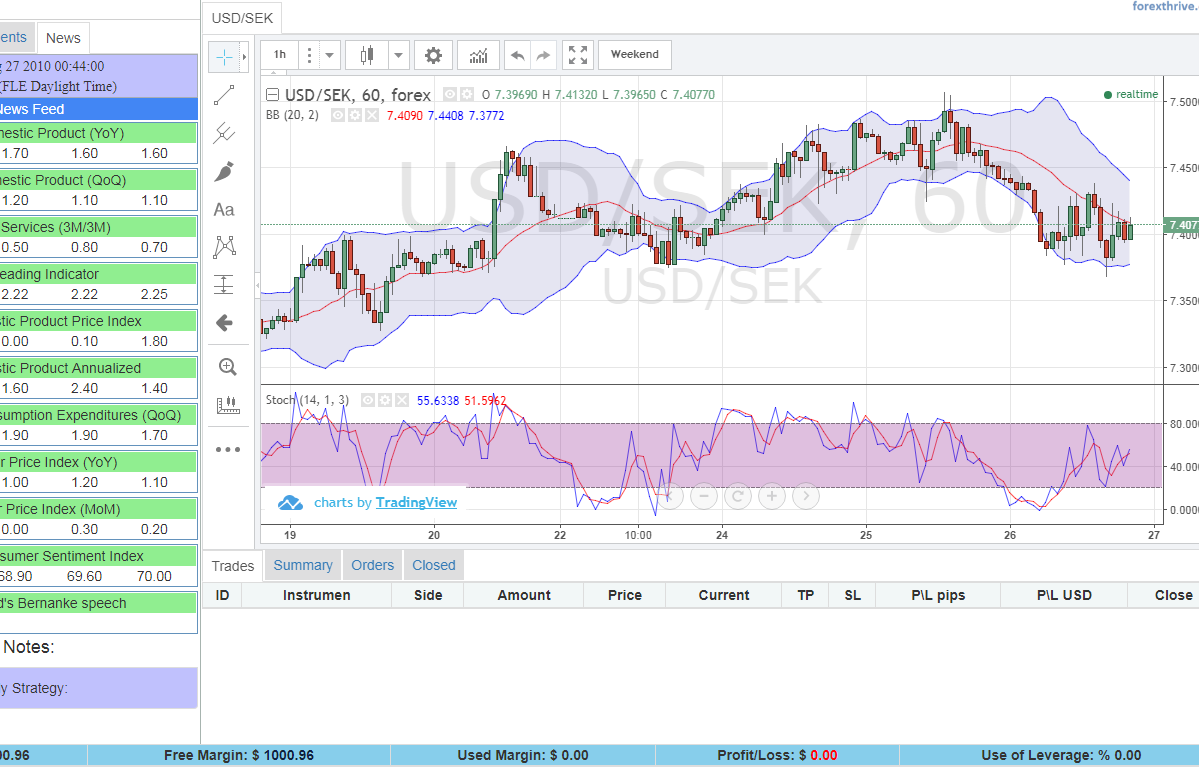

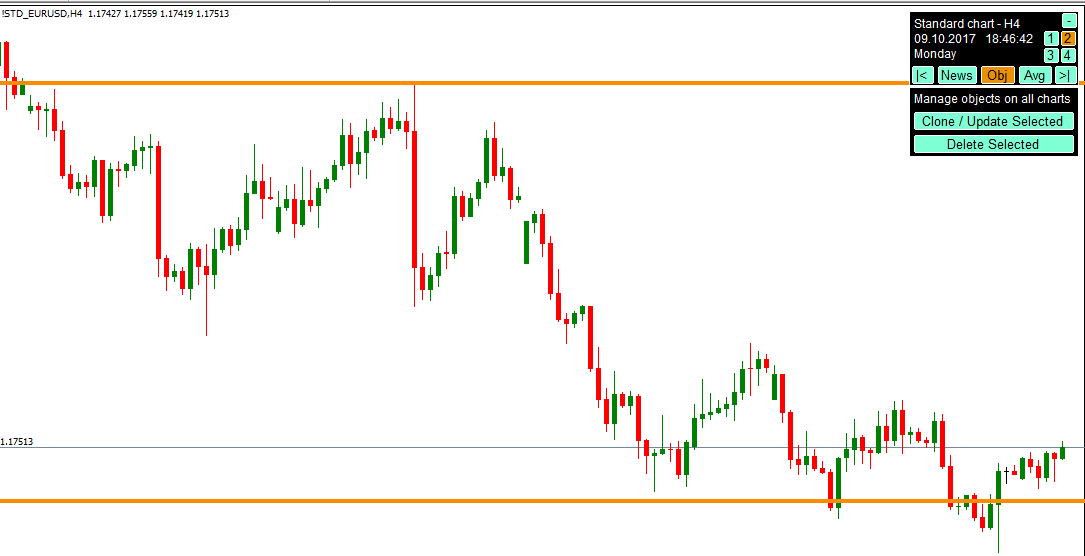

trading chart backtesting Backtesting trading is an effective strategy or a method to determine the market’s previous performance based on how well or negative the market had performed in the past. Backtestify is specifically designed to make it easy and fast for traders to backtest their strategies without the need of spreadsheets or. The backtesting engine lets you quickly evaluate historical market performance following a signal or assess the profitability of a trading strategy without any coding.

![Backtesting A Trading Strategy [Trading Basics] YouTube Trading Chart Backtesting](https://i.ytimg.com/vi/zhANhd4Y96E/maxresdefault.jpg)

Backtestify Is Specifically Designed To Make It Easy And Fast For Traders To Backtest Their Strategies Without The Need Of Spreadsheets Or.

Chart to backtest (ctb), powered by streak, converts the plotted chart and indicators into a set of conditions and generates a backtest result. Backtesting trading is an effective strategy or a method to determine the market’s previous performance based on how well or. Backtesting trading is an effective strategy or a method to determine the market’s previous performance based on how well or negative the market had performed in the past.

Leap From One Trading Session To Another.

To backtest, click on the. Backtest your strategy across different timeframes (daily, hourly, minute) to gain insights into its effectiveness on various market movements. The backtesting engine lets you quickly evaluate historical market performance following a signal or assess the profitability of a trading strategy without any coding.

Leave a Reply